The Renters Rights Bill- Key Changes

The Renters Rights Bill is designed to give tenants more protection and rights as well as stability to reside in their homes longer. Some of the changes will take effect on the commencement date of the Bill and others may take effect at a later date.

At present most tenancies are assured shorthold tenancies (AST) which are fixed for a period of time such as for 6, 12, or 24 months. After the fixed term, the AST becomes a periodic tenancy rolling on a month by month basis until a new AST is entered into for a fixed term or either the tenant or the landlord serves notice to terminate.

Under AST, tenants can be evicted from the property either by:

- Section 8 route

Section 8 route is whether the tenants have breached the terms of the tenancy and the landlord is requesting for that breach to be rectified otherwise they will claim possession of the property.

- Section 21 route

Section 21 route is regarded as the ‘no fault route’. This means that even if a tenant is paying all the rent on time and comply with all the terms of the tenancy agreement however, after the fixed term of their tenancy agreement, they can be evicted from the property.

Changes that the Renters Rights Bill will create

The new bill will create a new tenancy system whereby all tenancies will be an Assured Tenancy. This applies to all tenancies where:

- The rent is under £100,000 per annum

- The tenant is not a lodger

- The property that the tenant is renting is their sole or main home

As soon as the new Renters Rights Bill comes into effect, it will automatically turn all ASTs in to Assured Tenancies. There will not be any fixed term tenancies so all tenancies will be a rolling month by month (periodic tenancy) and will continue to be in force indefinitely until a tenant serves a Notice of Quit or the Landlord has grounds to evicts the tenant under the Section 8 route. This means that the Assured Tenancies does not need to keep being renewed and therefore, creates security for the tenants.

If a tenant decides to terminate the Assured Tenancy, they must give at least 2 months written notice being a Notice to Quit which must expire at the end of the rent period.

Rent Period

The Renters Rights Bill will enforce all tenancies to have a maximum of one month rent period – for when the rent is paid. This means that where rent is paid quarterly, termly or yearly, it will automatically be changed to monthly after the rent period.

The Proposed Rent

The landlord will be required to state the proposed rent on all new adverts and listings for new tenants. This is called the Proposed Rent.

Rental Bidding

The Bill prevents landlord’s from accepting more rent from a tenant who offers to pay more even if the landlord did not ask the tenant to pay more. This means that rental biding will be banned.

Applicants for new listings are allowed to offer under the proposed rent but the applicants cannot offer more than the proposed rent.

Terms of the Tenancy

The Bill prevents the term of the tenancy to be amended for landlords to request more than one month’s rent in advance. This therefore means that the landlord cannot make it a condition of the contract for the tenant to pay 3 or 6 months in advance.

However, a tenant may choose to pay rent in advance voluntarily once an agreement has been entered into.

Landlord will need to allow tenants to have pets and cannot unreasonably refuse – except if the lease says no pets.

Increase Rent

A landlord is able to increase the rent by serving a Section 13 Notice (using Form 4) however, this can only be done once per calendar year and the increase must be inline with market rent.

A tenant can challenge a Section 13 Notice for rental increase at the First Tier Tribunal. The new rent will not come into force until after the judge has made a decision. The judge has the power to reduce the rent if they believe the rental increase is above market rate and not in line with other similar properties in that area.

The landlord cannot include any rent review clauses and any pre-existing rent review clauses will be null and void.

Other Key Changes to come into effect at a later stage

- Landlord must keep a separate entries for each of their properties

- Landlord will need to register with the Landlord Ombudsman – landlord will have to pay a yearly fee towards this.

- Landlord’s must comply with the Decent Homes Standard – Government needs to set guidelines on this – such as state of repair

- Government to set out guidance on the time lines in which the landlord will have to make homes safe / fix any disrepair etc

Things that the Landlord must be aware

- Civil penalties from the local council have increased. Penalties can be up to £7k for the first offence and can increase to £40k for continued and repeated offences.

- Tenants can claim for Rent Repayment Order for up to 2 years

- Local authorities have the right to ask landlords for information and enter business premises

Landlords must be careful when evicting tenants and ensure that they are complying with the correct ground otherwise the landlord can face civil penalties. For example, if a landlord uses grounds 8 to evict a tenant claiming the reason for evicting the tenant is because the landlord is planning to move into the property then landlord cannot relet the property for 12 months. This is designed to prevent the landlord from abusing the grounds under section 8 to evict their tenants. If the landlord relets the property to another tenant within that 12 month period then the landlord can be fined up to £7k and the tenant can make a claim for rent repayment order.

In summary, some of the key points that the Renters’ Rights Bill intends to do is:

- Abolish section 21 evictions

- The grounds for possession to be fair for both the tenant and landlord

- Stronger protections for tenants and prevents unlawful eviction

- Creates a new Private Rented Sector Landlord Ombudsman

- Stricter rules on landlord to ensure that the property is up to a decent standard

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contactus using the contact form or email us on reception@cnsolicitors.com

Ending a Fixed Term Assured Shorthold Tenancy Agreement Without a Break Clause

How Can a Tenant End a Fixed Term Assured Shorthold Tenancy Agreement Without a Break Clause?

Ending a tenancy early is not always straightforward, especially when you’re tied into a fixed term with no break clause. If you’re a tenant wondering about your options, this article explains the key considerations and the possible routes you can take.

What is an Assured Shorthold Tenancy Agreement?

An Assured Shorthold Tenancy (AST) is the most common type of tenancy in England. It typically applies to private residential tenants who rent a property as their main home, and where the landlord doesn’t live on the premises.

ASTs usually run for a fixed term, often six or twelve months, during which both the landlord and the tenant are bound by the terms of the agreement. At the end of the fixed period, the tenancy may roll into a periodic tenancy (month-to-month) unless a new agreement is signed.

When Can You End a Fixed Term Tenancy Early?

Leaving a property before the end of your fixed term can be tricky. If your tenancy agreement includes a break clause, you may be able to end the agreement early, as long as you follow the proper notice procedures. However, not all agreements include a break clause — and if yours doesn’t, you’ll need to explore other options.

Bear in mind that you can’t simply give notice and leave during a fixed term without a break clause unless your landlord agrees. Doing so may result in financial consequences, including being liable for rent until the end of the term.

How to End a Tenancy Early

There are three potential routes to ending a fixed term AST early:

- Using a Break Clause

- If your tenancy agreement contains a break clause, it will set out the conditions under which you can end the tenancy early — for example, after a certain number of months or with a specific notice period (usually one or two months).

- Check your tenancy agreement carefully to see whether a break clause exists and what terms apply. You must follow the break clause wording precisely to bring the tenancy to an end lawfully.

- In the Absence of a Break Clause – A Deed of Surrender / Mutual Surrender

- If there’s no break clause, the most straightforward way to end the tenancy early is by mutual agreement with your landlord. This is usually done through a deed of surrender, which is a formal document where both parties agree to end the tenancy on a specified date.

- This agreement should ideally be put in writing to avoid any misunderstandings later. The landlord is not obliged to agree, but some may be open to ending the tenancy early, especially if they have another tenant lined up.

- Finding a Replacement Tenant or Subletting (With Consent)

- Another possible option is to find someone to take over your tenancy — either by transferring the tenancy (with the landlord’s permission) or by subletting. However, most ASTs prohibit subletting or assigning the tenancy without the landlord’s prior written consent.

- If you’re considering this route, you’ll need to discuss it with your landlord first. They may be willing to allow a replacement tenant, particularly if it avoids a vacant property. But again, the original tenancy agreement will guide what’s possible and what’s not.

What About the Renters (Reform) Bill?

The Renters (Reform) Bill, likely to come into effect in late 2025, proposes some significant changes to the private rental sector in England. One of the most notable reforms would be the abolition of fixed term (AST) altogether. Instead, all tenancies would become periodic, meaning they would continue on a rolling basis with no fixed end date. The AST would automatically become an Assured Tenancy.

For tenants, this could mean greater flexibility, allowing them to give two months’ notice to end a tenancy at any time — without needing a break clause or negotiating a surrender.

However, until the bill becomes law and is implemented, existing fixed term ASTs remain legally binding, and tenants are still subject to the current rules.

It’s important to stay up to date with developments around the bill, as it may affect your rights and options in the near future.

Final Thoughts

Ending a fixed term tenancy without a break clause is not always easy, but it is possible — provided you approach it in the right way. Whether by negotiating a surrender, checking for a break clause, or seeking permission to sublet, communication with your landlord is key.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Primary activity and source of revenue approach under Sole Representative visa route

Commonly known as a Sole Representative visa and formally called Representative of an Overseas Business visa, it was designed for employees of overseas companies to be recruited to set up and supervise a United Kingdom branch or a wholly-owned subsidiary. Being closed on 11 April 2022 for new applicants and replaced by a UK Expansion Worker route, this visa route continues to be employed by existing Sole Representative visa holders and their family members to extend their stay or settle in the United Kingdom.

The Sole Representative visa route, introduced on 1 October 2009, slowly gained popularity. As a number of applicants eventually grew, the Home Office started implementing tougher requirements and a more thorough approach to decision-making.

This post intends to bring attention to the existing Sole Representative visa holders the “primary activity and source of revenue” approach in the Home Office decision-making in a case of business diversification.

The purpose under the Sole Representative visa route is for the UK establishment to operate in the same business as its overseas parent company. This requirement must be met throughout the period the applicant requires to qualify for settlement in the United Kingdom, which in most cases is 5 years.

If the overseas company diversifies its business offerings, for example bringing new product lines or services that become the primary activity and the primary source of revenue, so must the UK entity. In our most recent settlement application under the Representative of an Overseas Business visa route, we had to dive deep into the “primary activity” and “primary source of revenue” approach to satisfy the Home Office requirements.

Essentially, “primary activity” is a core function of a business to generate revenue, whereas “primary source of revenue” is income generated from primary business activity. If the business has several activities, it is the activity that generates the most revenue is regarded as the business’s primary activity.

When the business starts diversifying its offerings, under the provisions of the Sole Representative rules, it is imperative that whatever activity becomes the primary activity of the overseas business, it also becomes the primary activity of the UK establishment. This is exactly what happened in our case, where the overseas business, due to the COVID-19 pandemic and the Ukrainian war, had to diversify its primary activity several times to ensure the continuous profitability. The UK establishments mirrored the parent company’s offerings.

During the application review process, the Home Office’s caseworker team thoroughly assessed the financial accounts of both parent and UK entities. The consideration was given to the revenue generated during each financial year and what business activity generated the most revenue at each point of the business’s diversification. The Home Office caseworking team also assessed the business’s website on whether it reflects the business’s current primary offering.

Interestingly, the Home Office also quired what experience and, if applicable, qualifications the Sole Representative applicant had to be able to successfully supervise the UK business in the wake of the overseas business bringing new offerings to the equation. This was not covered in the original application but was evidenced with the relevant documentary evidence in the additional information request received from the Home Office caseworking team. This only demonstrates how thorough the decision-making team is in their application review.

Our Immigration Team has many years of experience assisting Sole Representative applicants in their visa applications, often successfully taking on cases with a high degree of complexity.

Do not hesitate to get in touch for an assessment of your circumstances and advice on how we could assist.

What is Legal Separation

In England and Wales, couples can choose to live apart informally or legally. When a marriage is no longer working, many people opt for divorce. However, in some cases—whether due to financial reasons, emotional ties, or other factors —some couples prefer to separate while remaining legally married, making arrangements for property, finances, and children. Legal separation can therefore be seen as an alternative to divorce for couples who do not wish to legally dissolve their marriage.

Informal vs. Legal Separation

Couples who separate informally often enter into a separation agreement to outline arrangements for finances, property, and childcare. While not legally binding, a well-drafted agreement can carry legal weight and may be persuasive if later reviewed by a court.

In contrast, legal separation—formally known as judicial separation—requires an application to the court for a Judicial Separation Order. This grants legal recognition to the separation while allowing the couple to remain married or in a civil partnership. As part of this process, the court can make formal decisions about financial matters, property division, and arrangements for children, similar to those made during divorce proceedings.

Many couples initially choose informal separation due to its flexibility and lower cost, particularly when they are unsure about proceeding with divorce. However, obtaining a Judicial Separation Order does not prevent either party from later applying for a divorce.

Legal Separation vs. Divorce

Legal separation and divorce are both formal legal processes that allow couples to live apart. However, the key distinction is that legal separation does not legally end the marriage, whereas divorce completely dissolves the marital relationship. Below is a comparison of the two processes:

- Legal Status

- Both legal separation and divorce are recognised legal procedures.

- The primary difference is that legal separation allows spouses to live apart while remaining legally married, whereas divorce permanently ends the marriage.

- Court Proceedings

- Divorce is more complex, requiring multiple stages to finalise the dissolution of the marriage. It typically involves two orders:

- A Conditional Order (formerly Decree Nisi).

- A Final Order (formerly Decree Absolute).

- Legal separation does not require proof of an irretrievable breakdown of the marriage and only requires a single application for a Judicial Separation Order —there is no equivalent two-stage process.

- Divorce is more complex, requiring multiple stages to finalise the dissolution of the marriage. It typically involves two orders:

- Division of Assets

- Both legal separation and divorce involve financial settlements, including the division of property and assets.

- However, since divorce ends the marriage, the division of assets is typically more comprehensive and legally binding.

- A key distinction is that pension sharing orders can only be obtained through divorce, not legal separation. This is one of the most significant financial differences between the two processes.

Who Might Consider Legal Separation?

Legal separation may be a suitable alternative to divorce for couples who are uncertain about their future, not yet eligible for divorce, or wish to remain legally married for personal, financial, or family-related reasons.

- Religious or Moral Reasons

- Some religions or personal beliefs do not permit divorce. Legal separation allows couples to live independently while maintaining their marital status.

- Taking Time to Decide

- Some couples need time and space to assess whether their marriage can be reconciled before making a final decision on divorce.

- Married Less Than a Year

- UK law requires couples to be married for at least one year before filing for divorce. Legal separation allows couples to separate formally while waiting to meet divorce eligibility requirements.

- Financial Reasons

- Divorce in the UK can be a lengthy and expensive legal process. Legal separation allows couples to settle financial and childcare arrangements without immediately dissolving the marriage.

- Family Considerations

- Many parents prefer to avoid divorce to maintain a stable family structure. Legal separation allows them to co-parent effectively while remaining legally married.

- Financial Benefits of Remaining Married

- Tax benefits available to married couples.

- Pension entitlements that may be lost upon divorce.

- Inheritance rights, which may remain intact unless a will specifies otherwise.

- Emotional Considerations

- Some couples still have a strong emotional connection but cannot continue living together. Separation provides an opportunity to reflect on the relationship before deciding on divorce.

How to File for Legal Separation

Unlike divorce, there is no required period of separation before applying for legal separation. Couples can apply at any time after marriage if they wish to live apart while remaining legally married.

It is important to distinguish between legal separation and a separation agreement:

- Legal separation is a formal court process that requires a Judicial Separation Order, which legally recognises the separation while the couple remains married or in a civil partnership.

- A separation agreement is a private contract between spouses outlining arrangements for property, finances, and childcare. While not legally binding, it can carry legal weight and may be made enforceable if later approved by the court as a consent order.

What Is a Separation Agreement?

A separation agreement is a contract between spouses that outlines how finances, property, and child arrangements will be managed while they live apart. It helps couples define their rights and responsibilities without immediately pursuing a divorce.

Although it can be a formal legal document, it does not hold legal binding force on its own as it is not a court order. The court is not typically involved in drafting it, and it lacks the automatic legal enforcement of a divorce financial order. However, as a contract, it can still be challenged or enforced in court under contract law.

A well-drafted separation agreement can help couples avoid disputes and reduce legal costs if they later decide to divorce. Since the court may consider the agreement during divorce proceedings, it is essential that it is fair, clear, and properly drafted by an experienced family solicitor.

Impact on Future Divorce Proceedings

A separation agreement can set a precedent for a future divorce settlement. If the case goes to court, a judge may assume that, since both parties previously agreed to the terms, those terms should carry over to the final divorce settlement.

For this reason, it is essential to agree on fair and practical terms that you can live with long-term. Seeking professional legal advice can help ensure that your separation agreement protects your rights and interests.

At Chan Neill Solicitors LLP, our experienced family law solicitors can guide you through the legal separation process, helping you draft a comprehensive separation agreement that safeguards your financial and personal interests.

Understanding the Form E Financial Statement in UK Divorce Proceedings

Divorce is a complex process, particularly when it comes to financial settlements. In the UK, one of the key documents involved in this process is the Form E Financial Statement (“Form E”). This article will explore what Form E is, who needs to complete it, when it should be submitted, and how it impacts financial remedy divorce cases.

What is Form E?

Form E is a crucial document used in UK divorce proceedings to outline each party's financial position. It provides a detailed account of income, assets, liabilities, and financial needs, enabling the court to make informed decisions regarding financial settlements.

This form is mandatory in financial remedy cases where one party seeks a financial order from the court. Financial orders can include claims for spousal maintenance, property adjustment orders, pension sharing orders, and child maintenance. By ensuring full transparency of each party’s financial situation, Form E helps the court divide assets and responsibilities equitably between the divorcing parties.

Who Needs to Complete Form E?

Form E must be completed by both parties involved in a financial remedy divorce. This requirement applies regardless of whether the case is settled through mediation, collaborative law, or court proceedings. By completing this form, both parties fully disclose their financial situation, which is crucial for a fair assessment of the available financial resources.

Even when an agreement is reached outside of court, Form E may still be used to ensure both parties have a clear understanding of each other's finances. This can help prevent future disputes, especially if circumstances change or new financial information comes to light.

When Should Form E Be Completed, and What Are the Requirements?

Form E must be completed and exchanged before the First Appointment (the initial court hearing) in financial remedy proceedings. This typically occurs after the initial divorce petition has been filed and financial claims have been made. Failure to submit Form E on time can result in delays, and in some cases, the court may impose penalties or cost orders.

To complete Form E, individuals must provide detailed information about their finances, including:

- Income: Salary, bonuses, benefits, and other sources of income.

- Assets: Properties, savings, investments, and valuable possessions.

- Liabilities: Debts, loans, and other financial obligations.

- Expenditure: Monthly outgoing, living expenses, and future financial needs.

Supporting documents, such as bank statements, mortgage statements, and pension valuations must accompany the form to verify the information provided. The form also includes a Statement of Truth, where the individual confirms that the contents are accurate to the best of their knowledge. Inaccurate or incomplete disclosures can result in serious legal consequences, including contempt of court or adverse inferences being drawn against the offending party.

What Does the Court Take into Account?

When assessing Form E submissions, the court considers several factors, including:

- The length of the marriage

- The standard of living during the marriage

- The age and health of both parties

- Each party’s future earning potential

The court aims to reach a fair settlement that meets both parties' needs, particularly when children are involved. The court also considers significant changes in circumstances since the separation, such as changes in employment status, new relationships, or serious health issues. Each party's financial needs and obligations are carefully evaluated to ensure that the settlement is fair and sustainable in the long term.

The court relies on Form E to assess each party’s financial standing and determine appropriate financial orders, such as asset division, maintenance, and pension sharing.

Conclusion

Form E is an essential document in UK divorce proceedings, particularly in cases involving financial remedies. By providing a comprehensive overview of each party's financial situation, it enables the court to make fair and informed decisions about financial settlements. Completing the form accurately and thoroughly is crucial, as failing to disclose all relevant information can have serious legal consequences.

Understanding and accurately completing Form E is essential for anyone going through a divorce. If you're unsure how to proceed, seeking legal advice from Chan Neill Solicitors LLP can provide the guidance you need. With the support of experienced family law professionals, you can safeguard your financial interests and ensure a smoother divorce process.

Registration as British for Irish citizens

The political relationship between the United Kingdom and Ireland dates back to the 16th century. Being the closest geographical neighbour, Ireland is the most important UK’s economic, trade, investment and tourism partner. Both countries form a part of the Common Travel Area which allows British and Irish citizens to move freely and reside in either country without restrictions, including the right to study or work.

In light of the UK’s exit from the European Union in 2020, the rights of Irish citizens in the UK remained protected. It was, however, possible for Irish citizens, as for any EU nationals, to apply for a status under the EU Settlement Scheme and even apply after the 30th of June 2021 deadline if there are reasonable grounds for making a late application.

The immigration relationship between Ireland and the UK, however, has not always been tranquil. Recently, there have been tensions over migration in the wake of the UK-Rwanda Agreement as there has been an influx of migrants arriving in Ireland from Northern Ireland, which forms a part of the United Kingdom.

For those Irish citizens, who wish to obtain British nationality, there have been several routes to do so. The most common route is naturalisation. Other than this, Irish citizens can become British by birth, descent or double descent.

This year, one more route has been introduced with the passing of the British Nationality (Irish Citizens) Act 2024. The Act makes provisions for Irish citizens to become British by registration having lived in the UK for 5 years and without sitting a citizenship (Life in the UK) and/or English language test, as required under the naturalisation process. The two-section Act sets out the absences limit that has to be met along with the non-previous breaching of immigration laws rule. In special circumstances, the Secretary of State may treat these requirements as being satisfied where they are not.

The relevant provisions set out in the Illegal Migration Act 2023 are preserved in this new Act, which restricts certain persons from applying based on the initial irregular arrival to the UK. Notably, however, there are no restrictions on the time that an applicant must hold Irish citizenship before submitting the registration application. As such, an applicant commencing residence in the UK as a non-Irish citizen and later acquiring Irish citizenship can be eligible to apply as long as the overall time spent in the UK before the date of application is at least 5 years.

The Act makes a welcome addition to the current legislation framework. The demand for British citizenship from Irish nationals is, however, yet to be seen.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

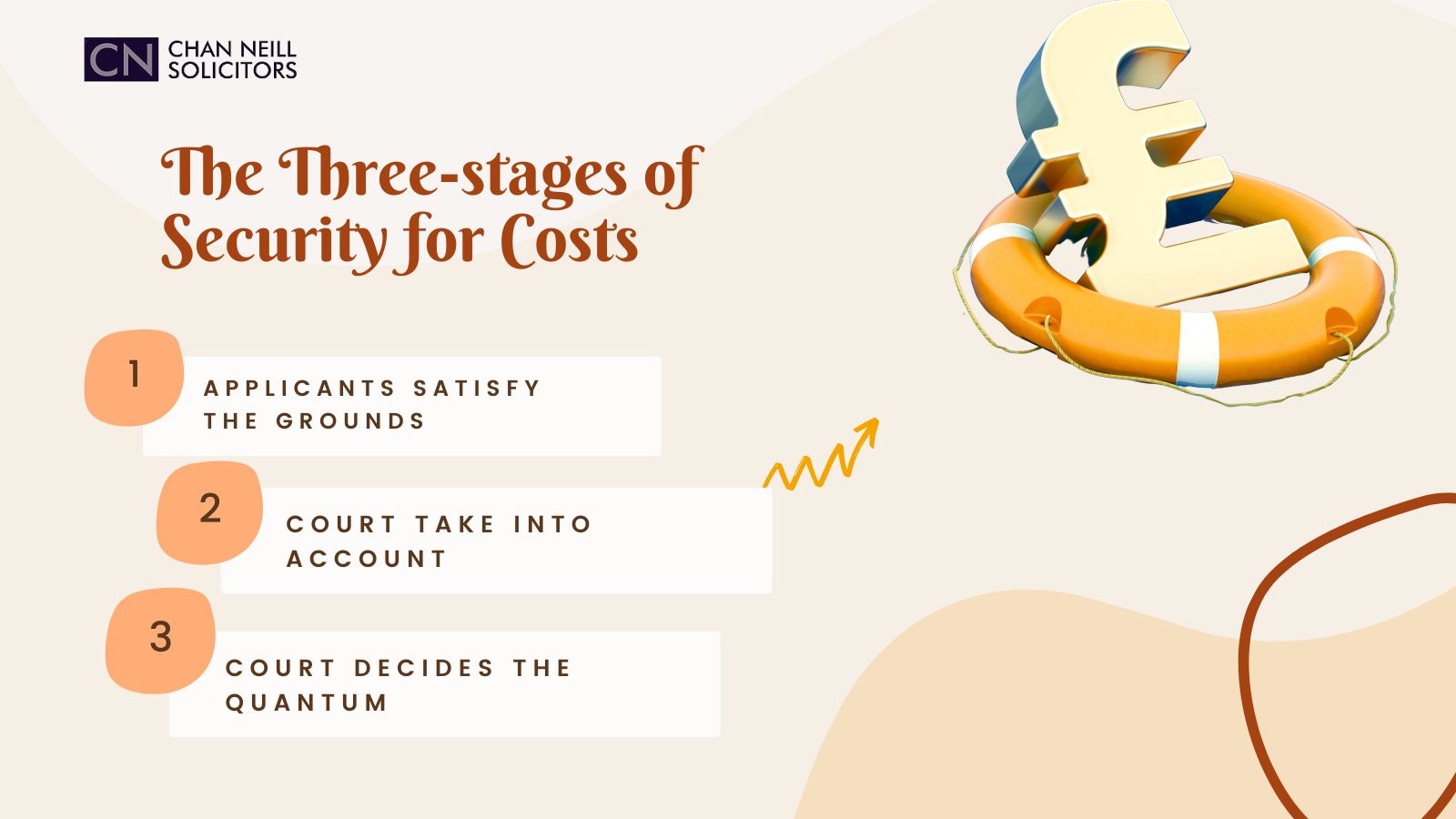

The Three-stages of Security for Costs

What is Security for Costs

Security for costs is an application that a party (Defendant during the proceedings) can make where they believe the other party (the Claimant) does not have the financial means to pay any legal costs awarded to the Defendant should the Claimant’s claim be unsuccessful at trial.

Who can apply for Security for Costs

Usually, an application for security for costs is made by a Defendant, however there are some circumstances where an application can be made by the Claimant (i.e. if the Defendant has made a counterclaim).

The 3-stage process that the Court consider

When the Court considers a security for costs application, there are three stages which are as follows:

- Grounds for Security for Costs

- Whether the Court should exercise its discretion

- Quantum

Grounds for Security for Costs

There are a number of grounds that the Applicant (the person making the application) must satisfy in their application (but not limited to) such as:

- Whether the Respondent resides outside of the UK (or is not a resident in a State bound by the 2005 Hague Convention)

- The Respondent’s address is incorrectly stated on the claim form

- The Respondent’s address is omitted from the claim form

- The Respondent has changed their address during the proceedings with the intention to avoid the cost consequences of the court proceedings.

What the Court’s take in to account

Applications for security for costs are usually dealt with at a hearing. The Court will consider all the relevant factors but not limited to the following points to decide whether the Court should exercise its discretion:

- Whether the grounds for Security for Costs have been satisfied

- How long the Applicant took to make the application

- The financial position of the Respondent

- The implications on the Respondent if an order for Security for Costs is made

- All circumstances of the case

- Whether the Respondent has After The Event insurance

Quantum

Once the court has decided that the grounds have been satisfied and that they should exercise their discretion to grant an order for security, the Court will then consider the amount of security and what form the security should be given.

Usually, the Applicant would request 100% of all their anticipated legal fees set out in their application (cost budget) however the court would review the Applicant’s anticipated costs and exercise their powers to assess the Applicants costs (like detailed assessment).

Conclusion

A party can make an application for security for costs at any stage during the court proceedings however, the earlier the application is made the better.

An Order for Security for costs is discretionary and the court would take in to account the time it has taken for the party to make such application which of course can have a detrimental effect on the court’s decision.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Artificial Intellegence – a conveyancer’s friend or foe

Technology's influence has been reshaping traditional practices for generations. Conveyancing is no different and conveyancers are now having to come to terms with the integration of artificial intelligence (AI). AI is transforming conveyancer’s day to day working lives. It is changing how conveyancers obtain search results, conduct due diligence, ensure security and navigate regulatory complexities. However, whilst the use of AI can be used as a force to enhance the industry’s effectiveness, there will always be those who see opportunities to fraudulently manipulate technology and AI is certainly no exception.

The conventional process of gathering search results has often been hindered by delays and cumbersome data retrieval. AI is changing this narrative by swiftly scanning and sorting through large volumes of data. AI expedites the extraction of pertinent information, providing conveyancers with a comprehensive overview in a fraction of the time it used to take. This acceleration not only reduces waiting times but also allows for prompt decision-making, a crucial element in the time-sensitive world of property transactions. AI's integration into the realm of conveyancing is not only accelerating the acquisition of search results but also reshaping our approach to information retrieval.

Due diligence, a crucial phase of any property transaction, has traditionally involved laborious manual searches through extensive volumes of data. AI has revolutionised this process by rapidly scanning large datasets to reveal any point of note associated with a property, its owners, and its prospective owners. By automating this data intensive task, AI accelerates due diligence timelines and reduces the risk of crucial information ever being missed. Conveyancers can now offer clients a more efficient and comprehensive due diligence process, enhancing trust and the speed of transactions.

Navigating the intricate network of regulatory compliance and legislative changes is a challenge faced by all legal professionals, and particularly for those working within the everchanging frameworks of property related regulations and legislation. AI allows conveyancers to constantly monitor amendments, to keep pace with changing regulations and legal requirements. Conveyancers can rely on AI to stay up to date with the latest guidelines and legislation, ensuring that every transaction adheres to the highest standards of legality as well as ethical practice. This insight provided by AI offers conveyancers a sense of assurance that their transactions remain compliant in a constantly changing regulatory landscape.

The incorporation of AI into conveyancing is not just about expediting processes; it's about improving the entire experience for both conveyancers and clients. AI's speed in gathering search results, its predictive abilities in risk assessment, its ability to streamline due diligence, and its ability to help ensure regulatory compliance are helping the industry toward a future marked by efficiency and accuracy. As AI continues to evolve and integrate seamlessly into conveyancing practices, the industry is in a position to offer an even higher standard of service and assurance to those navigating the intricate world of property transactions.

Like many industries at this point in time, the advantages AI provides conveyancers must be met with caution. Whilst AI has emerged as a powerful tool with the potential to revolutionise the field of conveyancing, it also brings forth its own set of threats that must be carefully considered.

One concerning aspect is the emergence of AI-powered fraud schemes. As AI technology becomes more sophisticated, criminals will exploit it to create intricate and hard-to-detect fraudulent activities. AI-driven algorithms can generate fake documents, impersonate identities, and manipulate data, posing significant challenges to traditional fraud prevention methods.

The vulnerabilities in cybersecurity cannot be ignored. AI systems themselves can become targets of cyber attacks. If fraudsters manage to compromise AI algorithms or access crucial data, they can leverage the technology against the very systems meant to safeguard against fraud, potentially exposing sensitive client information.

Recently, fraudsters have been able to use public data leaks to use AI algorithms in order to comb through email accounts involved in leaks. The criminal’s algorithms will identify those accounts containing emails with key-words associated with property transactions. Once identified, the fraudsters will target said accounts, the accounts of property purchasers more often than not, with emails enticing purchasers to send funds to fake client accounts. Whilst clients may recognise that something is not quite right with the emails, the importance of personal relations is evident here. A client having full knowledge of their transaction, knowing that this may be a strange time to send funds, will prevent them from ever doing so.

Another critical consideration is the issue of human oversight. Although AI excels at processing vast amounts of data and recognising patterns quickly, it lacks the nuanced judgment and intuition inherent in an experienced conveyancer. Relying solely on AI systems for fraud prevention may lead to false positives, flagging legitimate transactions as fraudulent, or false negatives, overlooking genuine instances of fraud. AI algorithms learn from historical data, which can contain implicit biases. This can inadvertently lead to discriminatory practices, where certain individuals or properties may be unfairly targeted or excluded from transactions based on historical patterns.

Additionally, legal and ethical challenges come to light with the adoption of AI in fraud prevention. Determining accountability and liability for AI related fraud can be complex, raising questions about who bears responsibility when an AI system fails to prevent fraudulent activities is a fresh issue the industry does not have a definitive answer to.

To address these concerns, it is essential to strike a balance between implementing the advantages of AI and the significance of human involvement. Combining AI systems with human expertise and judgment can ultimately enhance the overall effectiveness of fraud prevention measures.

Looking to the future, there is of course a risk of overreliance on technology. The convenience and efficiency that AI brings might inadvertently lead professionals to become complacent in detecting potential fraud when they overly rely on AI systems to handle the task. Combining this with the use of AI by fraudsters themselves and there is certainly cause to be cautious of AI and its impact on the conveyancing process.

Legal work will always be an industry which requires a human touch. Clients rely on a conveyancers personal experience and person ability in the same way they rely on their skills in dealing with the law. Incorporating AI into the world of conveyancing has to be a conscious process which considers all advantages and disadvantages. As always, the client, their goals and their experience, will remain at the heart of all legal work. Conveyancing is no different.

Account Freezing Order

What is an account freezing order (AFO)?

An AFO is an order granted by the Magistrates Court to freeze a bank account in the UK. This order is usually applied for by an enforcement officer, such as the police, if they have suspicion that the monies on account are part proceeds of criminal activities or intended for illegal purpose. The most common event is a large sum of monies transferred into a bank account or multiple deposits of cash into a bank account in a short period of time.

A common case

In a common scenario, you will first notice that you suddenly have no access to your bank account via mobile banking or online banking, or your balance in your account becomes zero. When you call the bank they may tell you that they are unable to deal with this or provide any information.

Shortly after, you either receive an AFO from the police or a notice of application for AFO from the court.

The threshold for the initial AFO application is quite low and the court is likely to grant it for an initial period of time.

Period of AFO

Once the AFO is granted, it would be subject to a period of time for the police to undertake the investigation as well as for you to provide an explanation and all evidence. The period of an AFO varies depends on the complexity of the case. The most common AFO lasts 6 months. If 6 months is not enough for you to the provide evidence or for the police to conduct the investigation, it could be extended up to 2 years.

Variation of an AFO

In the case that all monies that you could utilise are frozen in that bank account or you would need them for some urgent matter, you are entitled to make an application to the court to vary the AFO. You will need to demonstrate your reasonable living expenses and / or the urgency of the matter. You can also make application to pay your legal expenses from the frozen money.

Investigation

As mentioned above, during the investigation the police will ask you for an interview to answer questions they have or provide a written explanation of your funds. It is usually advisable to seek independent legal advice at this point before responding to the police. The main aspect is to give proper explanation for the funds in your bank account. For example, if some monies are your salary, you may need to provide your employment contract/pay slip or a confirmation from your employer if necessary to show that these monies are your rightful gain.

Possible results

If the police are satisfied with the clean source of funds, they will make another application to the court to set aside the initial AFO. Once the court approves that the police will inform the bank to unfreeze the account and release the monies to you.

It is also possible that, after the investigation, the police may decide to apply for the relevant amount or all of them to be forfeited, if they think those funds are the proceeds of crime. They will serve you a notice and you could raise an objection within a certain time period. If objected, you will need to make an application to set aside such forfeiture, the case will then proceed to the court for the judge to decide whether the forfeiture should be granted. You can seek legal advice for further details.

It is also open to you to apply to discharge the AFO if there are sufficient grounds

Seek legal advice

It is important to seek legal advice as soon as possible once you receive an AFO. Chan Neill Solicitors can provide expert guidance on the procedure and the best approach for your case. By assessing the validity of the AFO and carefully reviewing the evidence and circumstance surrounding the case, we can offer a variety of tactics to ensure the most favourable outcome for your case.

Financial Remedy

What is a Financial Remedy Order?

When a married couple petitions to divorce in the UK, they need to also resolve relevant financial issues. This is commonly referred to as financial remedy proceedings, with a Financial Remedy Order. This is a process by which a couple's assets and income are divided upon divorce or separation. The objective of financial remedy is to provide a fair and reasonable financial settlement between both parties.

Application

The procedure for financial remedy in the UK begins with an application to the court. The application form is called Form A. This application can be made by either party involved in the divorce or civil partnership dissolution. The application is made to the family court, which has the jurisdiction to hear and decide such cases.

First Appointment

Once the application is received by the court, the first step is to arrange a hearing to determine how to proceed with the case. At this hearing, the court will consider whether there is a need for further hearings and what type of financial remedy order is required.

The next step is to gather all relevant financial information from both parties. This includes assets, income, and expenses. Both parties are required to provide full disclosure in a Form E of their financial situation, including any debts, savings, pensions, and other assets. Both parties may raise questions regarding the disclosure. If a property is involved, the court may order to instruct an expert on valuation and tax issue. Failure to provide full disclosure can result in the court imposing a penalty.

Both parties shall exchange their proposals/offers to settle their case before the next hearing.

Financial Dispute Resolution Hearing (FDR)

If no settlement is reached, FDR will happen. The main objective of an FDR hearing is to encourage parties to reach an agreement on financial matters before proceeding to a final hearing, which can be expensive and time-consuming. The FDR hearing is an important stage in the financial remedy proceedings as it provides an opportunity for both parties to have a frank discussion and negotiate a settlement.

At the FDR hearing, the judge may provide an indication of how they would likely decide if the matter proceeded to a final hearing. This is intended to encourage parties to make a realistic settlement offer that is in line with what the judge might decide at a final hearing. If parties reach a settlement at the FDR hearing, it will be recorded in a legally binding court order, which can be enforced in the future.

Final Hearing

The Final Hearing is the last stage in financial remedy proceedings in England and Wales. It is where the parties present their evidence and legal arguments to the judge who will then make a final decision on how the couple’s assets will be divided. It is important to note that the vast majority of cases are settled before reaching the Final Hearing stage, either through negotiations or via alternative dispute resolution methods such as mediation or arbitration. However, if the parties cannot come to a mutual agreement, then the Final Hearing will be the final chance to make their case.

During the Final Hearing, each party will have the opportunity to present their case to the judge, including calling witnesses if necessary. The judge will then make a final ruling, taking into account all the evidence and legal arguments presented. The Final Hearing is a crucial part of the financial remedy process and it is important for both parties to prepare thoroughly to ensure the best outcome.

Conclusion

Financial remedy can be a complex and challenging process, and it is essential to seek legal advice from solicitors who have excellent knowledge and experience in family law.