Complete Guide to Entering the UK with an eVisa

If you are planning to travel to the UK, this is the latest step-by-step eVisa entry guide to ensure a smooth journey.

Step 1: Register a UKVI Account

Start by registering for a UK Visas and Immigration (UKVI) account on the official UK government website. This account is essential, as it allows you to view and share your eVisa details.

Tips:

- Provide basic personal details such as your name, nationality, and passport number.

- Use the same email address and phone number you used for your visa application. This ensures you can easily receive verification codes and important updates.

Step 2: Apply for an eVisa

Once you have registered your UKVI account, you can proceed with the eVisa application:

- Log into your UKVI account and select “Start application” on the website.

- Use the UK Immigration: ID Check app to verify your identity:

- Upload your BRP card (if you have one) and a self-portrait photograph of you.

- If you don’t have a BRP card, you can use your passport instead, provided it was used to register your UKVI account.

- After completing the identity verification section, return to the UKVI account to fill out contact details and answer security questions.

- Submit your application and wait for a confirmation email from UKVI, which will include a link to your eVisa.

Step 3: Prepare Entry Documents

Before traveling, make sure your eVisa is successfully linked to your passport information. This ensures border officers can quickly verify your visa.

In addition to your eVisa, prepare the following:

- Passport

- Flight tickets

- CAS (Confirmation of Acceptance for Studies) if you're a student.

Note: While eVisa is widely accepted, some airlines and border control officers may not yet fully support electronic visas. It is advisable to carry your BRP card as a backup if you have one.

Step 4: Entering the UK

At UK border control, present your passport and eVisa to the officers. In most cases, they will automatically verify your eVisa electronically. However, they may also request additional documents, such as:

- A letter from your school (if applicable)

- Your flight itinerary

Pro Tip:

- Double-check your eVisa details before departure, including your name, visa type, and validity period.

- For first-time travellers to the UK, having your visa vignette (sticker) and approval letter at hand is crucial. Familiarise yourself with UK customs and entry requirements to avoid delays.

Additional Tips:

- Regularly review your eVisa status and updates on your UKVI account.

- Print a copy of your eVisa confirmation email as a precaution, especially if traveling with an airline or through a border where eVisa support is limited.

By following this guide, you will be well-prepared for a seamless entry into the UK. Safe travels!

The 20-Week Cooling-Off Period: Balancing Reflection with Practicality

In April 2022, England and Wales reformed divorce law with the Divorce, Dissolution and Separation Act 2020, introducing a no-fault divorce system that allows couples to separate without assigning blame. A key feature is the mandatory 20-week cooling-off period, which begins when a divorce application is filed and must pass before a conditional order can be sought. This article outlines the UK’s no-fault divorce process and explores the debate around the cooling-off period, assessing whether it balances thoughtful decision-making with the need to avoid unnecessary delays.

The Divorce Process in England and Wales

Under the no-fault system, a spouse—or both spouses jointly—can apply for a divorce by stating that the marriage has irretrievably broken down. Unlike the old system, there is no longer a need to prove one partner's wrongdoing.

- Filing the Divorce Application and Acknowledgment of Service: The divorce process begins when one spouse (the applicant) submits a divorce application to the family court, or both spouses file jointly. Once the court receives the application, it sends an acknowledgment of service form to the respondent. The respondent has 14 days to complete and return the form, confirming receipt and awareness of the proceedings.

- The 20-Week Reflection Period: A mandatory 20-week period begins after the court issues the acknowledgment of service.

- Applying for the Conditional Order: Following the 20-week reflection period, the applicant(s) may request a conditional order, previously known as the decree nisi. The court will review the application to confirm that all procedural requirements have been fulfilled. If approved, a certificate of entitlement is issued, and a date is set for the conditional order to be formally pronounced.

- Applying for the Final Order: Six weeks after the conditional order is pronounced, the applicant(s) can apply for the final order, formerly known as the decree absolute. This final step legally dissolves marriage, granting both parties the freedom to remarry if they wish.

- Financial and Child Arrangements: Financial matters, such as the division of property, spousal maintenance, and pensions, may be resolved during the divorce but require a separate application for a financial order to make them legally binding. Similarly, if children are involved, custody, visitation, and support arrangements should be agreed upon and formalised through a child arrangements order.

Understanding the 20-Week Cooling-Off Period

The 20-week reflection period serves as a statutory interval designed to provide couples with time to reflect on their decision to divorce. The government asserts that this period encourages thoughtful decision-making and ensures that divorce is not pursued impulsively.

Critiques of the Cooling-Off Period

Despite its intended purpose, the mandatory 20-week period has faced criticism. Critics argue that it unnecessarily prolongs the divorce process, particularly for couples who have already engaged in considerable reflection before initiating divorce proceedings. By extending the overall timeframe for divorce, the 20-week period has led some to question its necessity.

This waiting period can also place additional emotional and financial strain on individuals seeking to move forward with their lives. In cases involving domestic abuse or high-conflict situations, it may exacerbate challenges or prolonged exposure to harmful circumstances

Support for the Cooling-Off Period

Supporters of the cooling-off period emphasize its role in promoting deliberate decision-making. Divorce is a life-altering event with significant implications for all involved, including children. The reflection period allows couples to consider the full impact of their decision, explore reconciliation, and make informed arrangements regarding finances and child custody. This time can be particularly beneficial in reducing impulsive divorces and encouraging amicable resolutions.

Balancing Reflection with Practicality

The 20-week cooling-off period in no-fault divorces aims to encourage thoughtful decision-making but has raised questions about its practicality. Balancing the seriousness of divorce with the realities faced by couples remains essential. In our view, a more flexible approach, such as exemptions or shorter timelines in agreed or urgent cases, could better accommodate diverse situations. As divorce laws continue to evolve, finding this balance will be crucial to ensuring the system works effectively for all.

At Chan Neill Solicitors LLP, we specialise in family law and understand the unique challenges of the 20-week cooling-off period. Our experienced solicitors provide tailored advice to protect your interests and guide you through the divorce process. Contact us today to see how we can assist you.

No Time Limit (NTL) - purpose, procedure and its future

No Time Limit (commonly known as NTL) is an administrative process that gained wider awareness in light of the rollout of the new digital immigration status (eVisa). For many years this application has served as a remedy to those who have had their indefinite leave to enter or remain status (also known as “settlement”) lost, stolen or expired. With the introduction of an eVisa, those who are unable to convert their “settled” status to the digital format due to lack of a valid Biometric Residence Permit (commonly known as a BRP) card, should lodge an NTL application to get the ILR converted to the digital format.

Historically, those who have their “settled” status endorsed in an old passport or hold the status in the form of a legacy document, could convert it to a BRP to evidence the right to work or rent in the UK or to facilitate travel. As a procedure went, the Home Office required the applicant to provide evidence of UK residency since being granted the status and to confirm that the applicant has not left the UK for more than 2 consecutive years at any point in time. This became an issue for those, who were granted the ILR status decades ago or who cannot evidence the residency (e.g. due to unemployment).

On the 11th of October 2024, the Home Office held a webinar session on the NTL applications, during which they confirmed that if the applicant can provide evidence of holding indefinite leave and has not lost it by being absent from the UK for 2 consecutive years, no evidence of UK residency should be requested. The application form will be simplified to streamline the process. The current processing time is around 3 months.

The question was posed as to what approach the Home Office will take when receiving applications where there was more than a 2-year absence during the COVID pandemic but there was no break in UK residency since. Such applications, as confirmed by the Home Office, will be decided on a case-by-case basis. As a reminder, since 6 July 2018, those who have been absent from the UK for 2 consecutive years and whose ordinary residence isn’t in the UK, must apply for entry clearance as a returning resident.

The Home Office also confirmed that there is no immediate need to apply for NTL but there will be benefits in doing so. In light of the hostile environment, it is yet to be seen whether ILR status holders (otherwise than in digital format) will experience any issues as of the 1st of January 2025, especially when travelling abroad, however, it seems that the whole purpose of digitalising the immigration status is to stop accepting paper documents sooner rather than later. Having said that, the Home Office has confirmed that Right of Abode (ROA) holders, who usually have their passport endorsed with an ROA vignette, will not be able to convert the status to the digital format at any time soon.

With BRP cards going out of circulation at the end of October 2024, NTL applicants will be able to create an eVisa account as a part of the NTL application process. Those who lost BRP recently but still have a record of its number, can create an eVisa account using the BRP number without going through the NTL process.

Our immigration team is well-versed in the NTL process. Do not hesitate to reach out for assistance.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

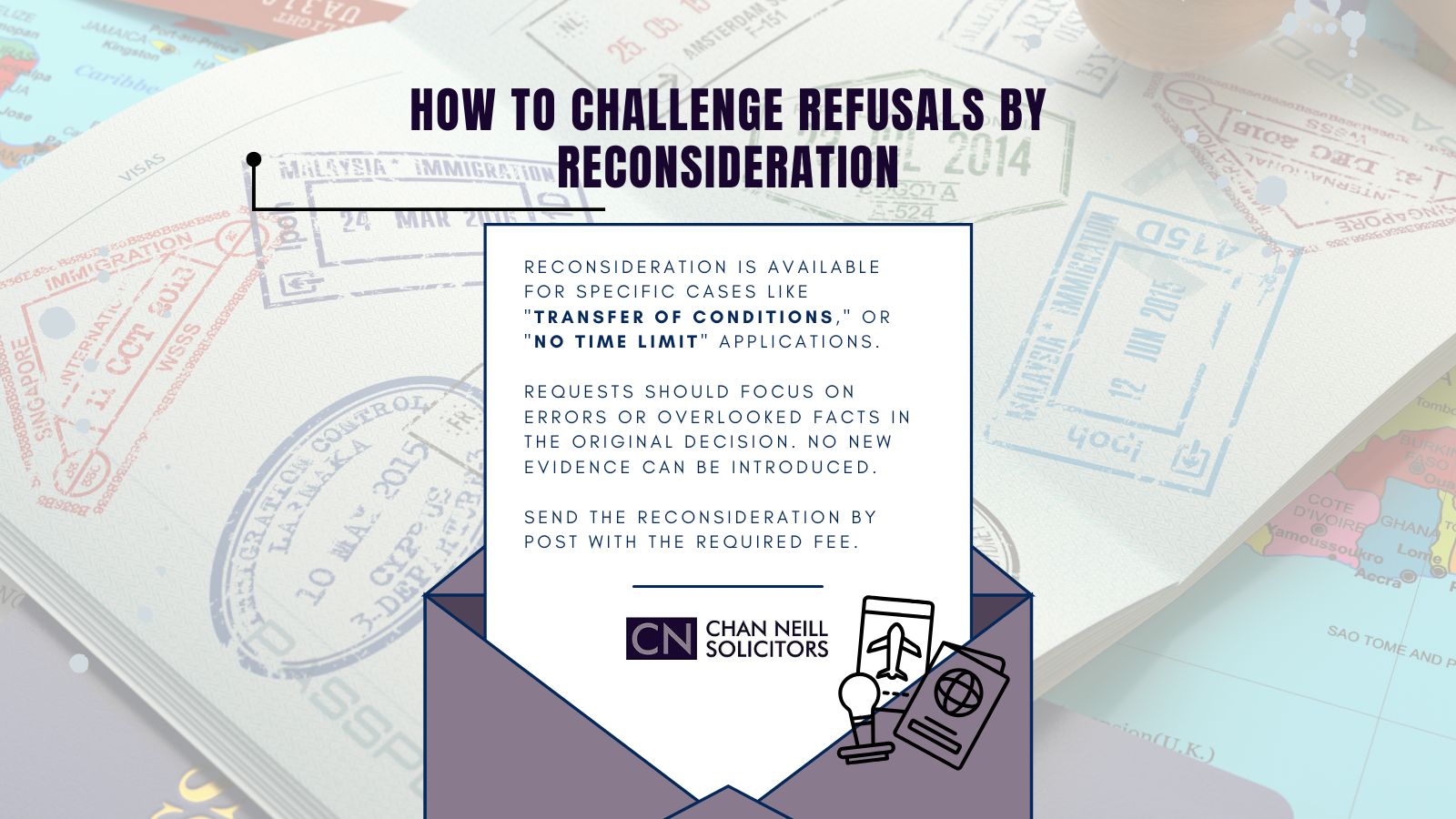

How to challenge refusals by reconsideration

Under the UK Immigration Law, the right to challenge the Home Office’s decision to refuse a visa application, in most cases, takes the form of an Administrative Review or an Appeal. However, in certain circumstances, for example, in a nationality, “transfer of conditions” or “No Time Limit” applications, such right is not granted. Such refusals are best to be challenged in the form of a reconsideration request.

The Home Office is not legally required to reconsider its decision but may do so in certain circumstances. The reconsideration request is reviewed by a senior caseworker of the same grade as the one who made the original decision, but not by the same person.

When preparing the reconsideration request, attention should be given to the facts of the case, which may have been overlooked by the original caseworker, and the documents that were submitted with the original application. The new evidence or information will not be accepted at the reconsideration stage. To aid the arguments at the reconsideration, it is advisable to request a full copy of the applicant’s UK Immigration file, which, in most cases, would shed light on the decision-making process and reasons for the refusal.

The reconsideration request is sent by post and attracts the Home Office fee. The processing time can be lengthy, with nationality cases taking approximately one year to conclude.

If the reconsideration request is not successful and the original decision to refuse the application is upheld, the next remedy is the pre-action protocol (PAP) letter followed by, if necessary, the Judicial Review (JR) application.

Our immigration team is not new to the reconsideration request procedure. We have successfully represented clients in nationality cases and helped to amend the period of limited leave to remain granted in error. Do not hesitate to reach out for assistance.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Business Expansion Visa - A secret weapon in the context of economic globalisation

Economic globalisation is an inevitable trend. In the post-pandemic era, the global economy is gradually recovering, and cross-border development has become a pursuit for many companies looking to expand their business footprint.

As one of the world's most important financial centres, London naturally becomes the first choice for many overseas enterprises looking to enter the international market.

To align with this trend, the UK Home Office has introduced the Global Business Mobility (GBM) route, which consists of five types of visas:

- Expansion Worker Visa

- Senior or Specialist Worker Visa

- Graduate Trainee Visa

- Service Supplier Visa

- Secondment Visa

What is the Expansion Worker Visa?

The Expansion Worker Visa allows overseas companies to send one or more senior managers or specialist employees to the UK to establish a branch that has not started trading in UK yet.

Comparing it to the previous Representative of an Overseas Business Visa:

Advantages:

- A company is no longer limited to sending just one representative; multiple employees can now be sent to establish a branch and conduct business in the UK.

Disadvantages:

- This visa is valid for a maximum of 2 years, with each issuance lasting 1 year.

- The time spent on this visa cannot be accumulated towards the 5-year residency required for settlement.

Please note:

Priority service is not available for the application for the Expansion Worker sponsorship license therefore, the decision could take up to six months. Therefore, it is advisable to consult with an immigration specialist in advance to secure the sponsorship license as quickly as possible.

Eligibility Requirements:

The Expansion worker must have worked for the employer outside the UK for at least 12 months, evidenced by 12 months of pay slips. If the applicant's annual salary exceeds £73,900, the work duration requirement is waived, and fewer pay slips can be provided.

The applicant must meet the minimum annual salary requirement of £48,500 or the current salary requirement for the role as listed in the occupational list, whichever is higher.

The applicant must be engaged in an eligible occupation, such as Chief executive, engineering manager, finance manager, sales director, marketing manager, etc. (For a specific list of eligible occupations and codes, refer to the link: Global Business Mobility Eligible Occupations and Codes).

Documentation requirements for Expansion Worker Visa:

Basic information and documentation include:

- Certificate of Sponsorship (CoS): including reference number, employer name, and employer's sponsorship licence number

- Passport and national identity card

- Proof of the applicant's job position and salary, such as employment contract, confirmation letter of employment, payslips

- UK occupation code

- Maintenance funds proof: a bank statement showing at least £1,270 in savings for 28 consecutive days

- Tuberculosis test report: required for some countries (detailed list available at TB Test for UK Visa) https://www.gov.uk/tb-test-visa/countries-where-you-need-a-tb-test-to-enter-the-uk)

Please note:

- If the applicant has been living in the UK for 12 months, maintenance funds proof is not required.

- The visa application must be submitted within 3 months of receiving the CoS.

- All documentation must be in English or translated by a certified translation agency.

- The immigration office may request additional documents, depending on the applicant's background.

The initial Expansion Worker Visa allows the applicant to stay in the UK for up to 12 months. Upon expiration, it can be extended once, however, each applicant is limited to one extension. This means the maximum stay on this visa is 2 years.

After the Expansion Worker Visa expires, it is possible for the applicant to switch to other long-term visas or other visas under the Global Business Mobility route, such as the Senior or Specialist Worker Visa or the Skilled Worker Visa upon meeting the requirements.

Please note:

If you have held an ICT visa and visas under the Global Business Mobility route, the total time on these visas cannot exceed 5 years within any 6-year period.

The application fee for the initial and extension is £298. The processing time for application outside the UK is 3 weeks, and for applications within the UK, it is 8 weeks. Please refer to the government website for the most up to date information.

Applicants can also apply for dependent visas for their partner and children.

Summary

Advantages:

- Allows overseas companies to send multiple employees simultaneously.

- No language requirement.

- Lower financial maintenance requirements.

- Low visa application fee.

Disadvantages:

- Does not lead to settlement in the UK

- Short visa duration

- High annual salary requirement

- High requirements for the parent company

For Companies: The Expansion Worker Visa allows the parent company to send multiple senior employees to the UK to establish a branch, making the business expansion process more efficient compared to the Representative of an Overseas Business Visa, which only allowed one representative. This is ideal for overseas companies looking to expand their business in the UK. It is also a type of guarantee when using a mature parent company to address multiple employees' work and living needs in the UK simultaneously.

For Applicants: The preparation period and costs for applying for this visa are extensive, requiring a strong background from the parent company to meet the sponsorship requirements. To stay in the UK and obtain permanent residency, applicants need to switch to different visa types, increasing the time cost for applying for permanent residency.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com[/vc_column_text][/vc_column][/vc_row]

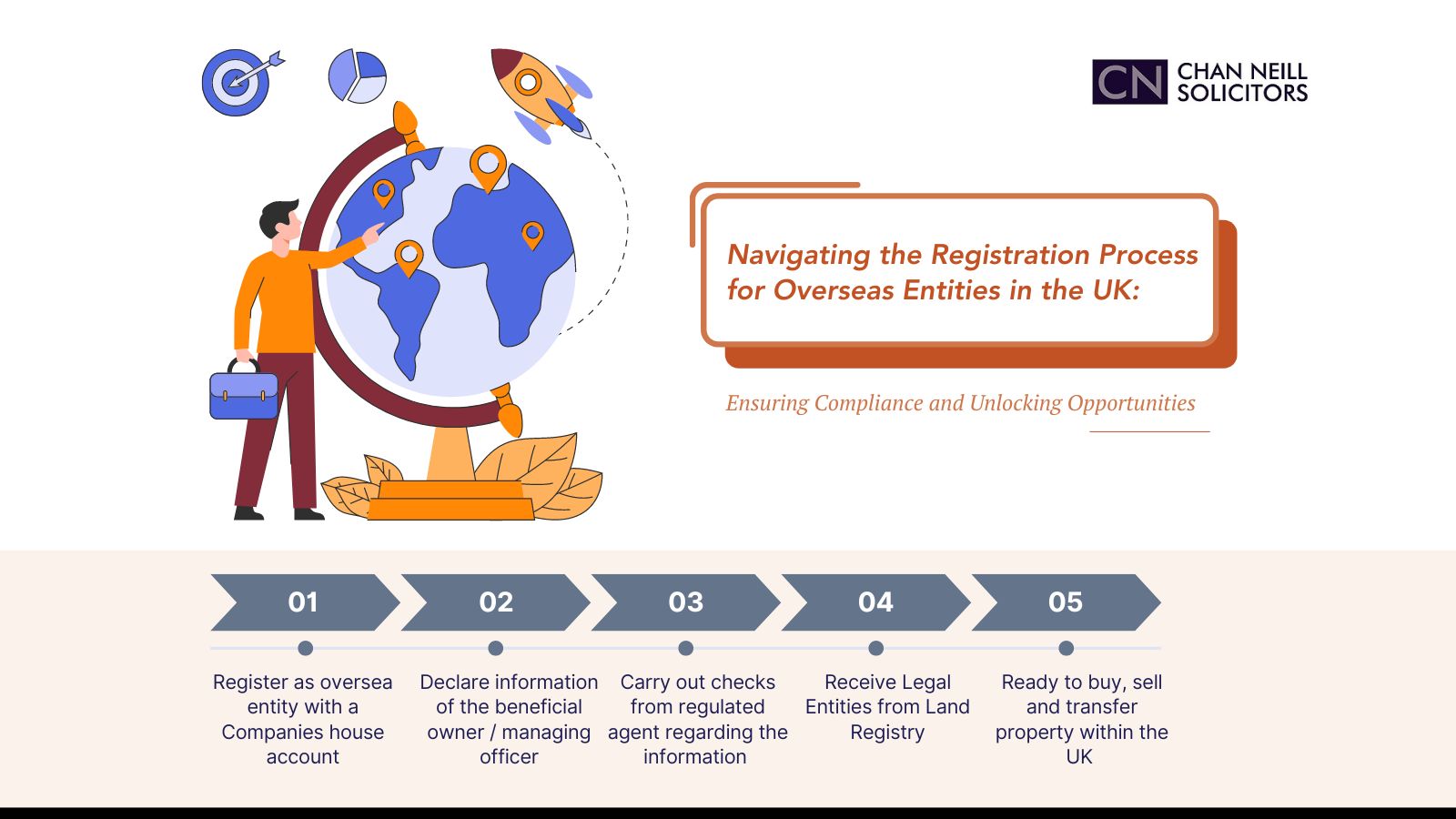

Navigating the Registration Process for Overseas Entities in the UK: Ensuring Compliance and Unlocking Opportunities

The UK continues to attract businesses from all corners of the globe. With its business-friendly infrastructure, environment and history, the UK remains a top destination for international entities seeking to establish a presence. However, for overseas companies looking to operate within the UK, navigating the regulatory landscape can be a daunting task.

One crucial step in this process is the registration of overseas entities, a procedure designed to ensure transparency, accountability, and compliance with UK laws. The Register of Overseas Entities (RoE) was established by the Economic Crime (Transparency and Enforcement) Act 2022 (ECTEA). It is regarded as an important step in dealing with global economic crime and furthering legitimacy within the UK property market.

The registration of overseas entities in the UK falls under the control of the Companies House, the government agency responsible for maintaining the official register of companies in the UK. Overseas entities seeking to establish a presence in the UK have historically had to register as an 'overseas company' if they plan to carry out business activities within the jurisdiction. On 26 October 2023, the ECTEA received Royal Assent, meaning that overseas entities which own UK property or land must declare information regarding their beneficial owners and/or managing officers.

To apply to register an overseas entity and its beneficial owners, the entity will require a Companies House Account. Detailed information about the overseas entity is required and its beneficial owners and/or managing officers will need to supply information about any relevant trusts, alongside the registration fee. A UK regulated agent based in the UK, often a law firm such as ourselves, must also confirm that they have carried out the requisite verification checks on the information regarding the beneficial owners and/or managing officers. It is therefore quicker and easier for the UK regulated agent to carry out the registration process themselves.

While the registration process may seem complex at first glance, it offers several benefits for overseas entities seeking to establish a foothold in the UK property market.

Legal Recognition: Registration as an overseas company provides legal recognition and legitimacy, enhancing the entity's credibility and reputation in the UK market.

Access to Markets and Opportunities: Registered overseas entities gain access to the vast UK market and can capitalise on business opportunities, partnerships, and investments within the country.

Enhanced Transparency and Compliance: By registering with Companies House, overseas entities demonstrate their commitment to transparency and compliance with UK laws and regulations, fostering trust among stakeholders and potential partners. If Companies have made an error in applications or have been delayed in registering, a concerted effort to communicate reasoning with Companies House should still be appreciated as a commitment to the transparency and compliance the ECTEA intended.

Protection of Rights and Interests: Registration affords overseas entities legal protections and safeguards their property within the UK, including the ability to sell, buy and lease the properties as well as resolve disputes surrounding the properties through the British legal system.

Once the entity has registered with Companies House, it will be issued with an overseas entity ID number (OEID). When the entity then enters property transactions, this number will be supplied to the Land Registry. The entity will then be able to buy, sell and transfer property within the UK whilst satisfying the regulatory requirements.

In an increasingly interconnected world, the registration of overseas entities in the UK serves as a gateway for foreign companies to new opportunities. While the process may involve complexities and regulatory requirements, it offers numerous benefits for businesses looking to expand their operations into the UK and its property market.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Relationship breakdown and separation: Impact on a UK visa

Most of the visa pathways under the UK Immigration Rules allow dependent partners, which include spouses as well as unmarried partners to join their British Citizens, settled persons or leading applicants under the various visa routes in order for them to continue enjoying family and private life in the UK. It is, however, unavoidable, that every relationship goes through a fair share of ups and downs and in some cases, results in separation and divorce.

As far as the Home Office is concerned, every separation or divorce from a UK-based partner must be reported. This is because the visa of dependent partners depends on the relationship in question, making their stay in the UK limited to the leading applicant’s visa or visa validity on family routes.

Different rules apply to family members of the BN(O) Status Holders, where the subsequent applications for leave to remain or settlement do not require proof of a subsisting relationship. Similarly, in EUSS cases, each individual with a visa granted under the EUSS Scheme has leave in their own right. As such, the test of proportionality must be applied by the Home Office before considering visa cancellation.

The reporting can be made by either the visa status holder or the sponsoring partner. There is an electronic application form that can be found on the GOV.UK website is specially designed for this purpose.

The ultimate question is what happens to a valid UK visa after the necessary reporting has been made to the Home Office?

According to the Home Office’s internal procedure, once the notification of the relationship breakdown has been received, the case will be considered for cancellation and the visa will be curtailed to 60 days unless there are exceptional reasons to cancel permission with immediate effect or the individual has less than 60 days permission remaining. During the curtailment period, an alternative visa status can be sought via other permittable UK visa routes.

If there is a reliable indication that the UK visa holder has been a victim of abuse or domestic abuse at the hands of their UK spouse or partner, the curtailment will not be persuaded. This, however, excludes cases where the lead applicant holds a temporary UK visa (for example under the Point-Based System).

It is a common practice that the decision to cancel a UK visa is served via email but can also be sent by post to the last known address where the email address is not provided. It is advisable to regularly check a spam folder in the email account as the Home Office communication can land there.

In the most recent judgment on this matter [2024] EWHC 1097 (Admin), the claimant challenged the Home Office visa refusal on two grounds, one of them being the statutory presumption of service. The judge accepted that the curtailment decision served via email was capable of being rebutted, however, without any substantial evidence it was impossible to ascertain. The onus is on a UK visa holder to regularise their immigration status as soon as possible following the relationship breakdown, even, if they have been unaware of the reporting being made to the Home Office by the other party to the relationship.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Navigating Business Restructuring: Strategies for Success in Turbulent Times

Introduction

Due to the interconnected global economy, markets are experiencing significant disruptions causing turmoil and challenges for businesses and their stakeholders. Successfully guiding clients through complex restructuring and insolvency processes across borders demands not only experience but also a global presence, expertise in advising diverse stakeholders, and seamless coordination across legal domains.

Understanding Business Restructuring

Business restructuring is an important process that businesses go through to deal with tough economic times, adapt to changes in their industry, or fix internal problems. Making it work usually means making smart decisions, working together with everyone involved, and being ready to change how the business operates. This article looks at real examples of companies that have successfully restructured their finances, showing what they did and how it helped their overall business.

Legal Considerations in Business Restructuring

Legal considerations play a vital role in business restructuring. It is integral to business restructuring to encompass regulatory requirements and contractual obligations. Understanding the relevant regulatory framework is essential to ensure compliance with corporate governance, securities laws, and industry-specific regulations. Managing existing contracts may necessitate renegotiation or termination, whilst adherence to employment laws is critical, especially concerning workforce changes. Moreover, considerations such as intellectual property, taxes and environmental regulations must be carefully evaluated to avoid legal complications. A comprehensive grasp of the legal landscape is vital for effective restructuring, risk mitigation and regulatory compliance.

Steps in Business Restructuring

Preparing for restructuring is similar to laying the groundwork for a major renovation project. It involves a comprehensive examination of the company's financial health and operational efficiency, identifying areas that need improvement and devising a detailed plan to address these issues. This plan should outline specific objectives, strategies and timelines, serving as a roadmap for the restructuring process. Seeking input from financial advisors and legal experts can provide valuable insights and help anticipate potential challenges that may arise.

Negotiating and documenting the restructuring plan requires collaboration with various stakeholders, including creditors, suppliers and employees. This entails renegotiating contracts, restructuring debt agreements and formalising legal documents such as restructuring plans and employment contracts.

Throughout this process, clear communication, transparency, and attention to detail are essential to ensure everyone is aligned and the restructuring strategy is executed effectively. By carefully laying the groundwork and meticulously planning each step, companies can navigate the complexities of restructuring with confidence and achieve their desired outcomes while safeguarding the interests of all involved parties.

Conclusion

Navigating the complexities of business restructuring requires a comprehensive understanding of the interconnected global economy and the legal landscape. With expertise in debt finance, restructuring, and litigation, our team is well-equipped to guide clients through the intricacies of restructuring, safeguarding their interests and achieving long-term success.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Continuous residence rule in the Long Residence applications

The main requirement for the Long Residence visa category is to spend at least 10 years in the United Kingdom lawfully. The word “lawfully” is defined as having valid permission to be in the UK, such as for study, work, family purposes (but not permission as a visitor or short-term student or a seasonal worker).

The 10-year period that includes time spent in the UK unlawfully is not covered by this post. More information on this can be found in Appendix Private Life.

Appendix Long Residence

The Statement of Changes (“SoC”) in Immigration Rules laid before Parliament on the 14th of March 2024 (HC 590) introduced big changes to the Long Residence route. As such, a new requirement was brought in for applicants to have had their current permission for at least one year before attempting a settlement application under the Long Residence route. In addition, it altered the way of meeting the “Continuous residence” requirement by introducing new absences calculation technique “for greater consistency across immigration rules” [quoted from the Explanatory Memorandum to the SoC (HC 590)]. Although consistency is a value of paramount importance, it remains questionable whether the primary legislation needed consistency in this particular instance.

The newest edition of the Immigration Rules for Long Residence visa route can be found in a recently introduced Appendix Long Residence, which replaced the provisions in Part 7 of Rules. It includes requirements for Permission to stay, Settlement as well as the Transitional arrangements for those, granted an extension of stay on the basis of Long Residence on or before 8 July 2012. The main difference between Permission to stay and Settlement routes is that in the latter, the English Language and Life in the UK test requirements must be met.

Historical background to “Continuous residence” requirement

The Immigration Rules for the Long Residence visa route were first laid before the House of Commons on 31 March 2003 (Statement of Changes HC 538). From there on, and until the 11th of April 2024, ‘Continuous residence’ in the Immigration Rules was defined as:

“residence in the United Kingdom for an unbroken period, and for these purposes a period shall not be considered to have been broken where an applicant is absent from the United Kingdom for a period of 6 months or less at any one time, provided that the applicant in question has existing limited leave to enter or remain upon their departure and return, but shall be considered to have been broken if the applicant:

….

(v) has spent a total of more than 18 months absent from the United Kingdom during the period in question.”

In one of our past articles, we wrote about the Immigration Rules being interpreted differently by the Home Office and the applicants themselves, resulting in refusals and subsequent litigations. The article was focused on the correct interpretation of “existing leave to enter or remain upon their departure and return” within the definition of ‘Continuous residence’, setting out the case law that impelled changes in the Home Office’s decision-making practices. Some years later, the definition of “18 months” was challenged.

Historically, “18 months” was defined by the Home Office as being 540 days. The case [2021] UKUT 65 (IAC) challenged this approach and brought the change to the interpretation of 18 months being 548 days.

Notably, the wording of the relevant paragraph of the Immigration Rules remained unchanged. However, the Home Office’s approach to applying the “Continuous residence” definition in the casework practices was revised.

With the new SoC (HC 590), the Home Office decided that there was time to change the primary legislation, that hadn’t been amended since 2003, and to do so in respect of the absences calculation under the “Continuous residence” requirement. With the new Rules, the 548 days became law rather than a guidance. However, the new absences calculation technique has caused much confusion as the correct approach depends on when the 10-year qualifying residence is completed. The Home Office is known for introducing the requirements that are bafflingly complex and the new Rules under Appendix Long Residence have not been an exemption.

New absences calculation

As of the 11th of April 2024, to meet the “Continuous residence” requirement, the time spent outside of the UK should be calculated as follows:

| 10-year period completed before 11 April 2024 | No more than 548 days during the 10-year qualifying period

No more than 184 days at any one time

|

| 10-year period completed on/after 11 April 2024 | No more than 184 days for any single absence started before 11 April 2024

No more than 180 days in any 12-calendar month period |

Essentially, the Home Office has given the prospective applicants more flexibility in terms of how much time they can spend outside of the UK during the decade in question. However, the concern now arises from the discrepancy in the wording of the Immigration Rules and the Home Office operational guidance in relation to the absences calculation. Such discrepancy is a potential pathway for litigations that, as history serves, may well alter the Home Office's decision-making practices in the future.

Note: This article was prepared on the 25th of April 2024 in line with the version of the Immigration Rules and relevant Home Office operational guidance in place on this date.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

How to navigate salary thresholds under the work visa routes

A new Statement of Changes to the Immigration Rules, laid before Parliament on the 14th of March 2024, introduced a sharp increase to the minimum salary thresholds for work routes, including Skilled Worker, Health and Care, Scale-Up and Senior or Specialist Worker routes. In addition, the Shortage Occupation List was replaced by a new Immigration Salary List, specifying the occupations where a reduced salary threshold applies in the Skilled Worker route and the Standard Occupation Classification (SOC) code system was updated from SOC 2010 to SOC 2020. The Home Office has also introduced transitional arrangements for existing work visa holders.

This has resulted in the expansion of the Appendix Skilled Occupations from three tables to six and in the version of the Rules which is difficult to follow. The Home Office operations guidance, which was updated on the 4th of April 2024, is not much of a help. Moreover, there are noticeable discrepancies in the Rules and guidance as well as operational issues since the implementation of the new Rules.

There is a hope that the Home Office will address the identified issues promptly. In the meantime, this post intends to shed light on how to navigate different salary levels when sponsoring migrant workers on the work routes.

Transitional provision

The starting point is to identify whether the prospective applicant falls within the transitional provision. The transitional provision applies when:

- The prospective applicant was granted permission as a Skilled Worker before the 4th of April 2024 and they have had continuous permission as a Skilled Worker since, and the date of application is before 4 April 2030; or

- The prospective applicant’s Certificate of Sponsorship (“COS”) was assigned before the 4th of April 2024 and they have had continuous permission as a Skilled Worker since, and the date of application is before 4 April 2030; or

- The job is eligible for the Health and Care ASHE visa (some conditions apply). More information can be found in paragraph SW A1.1. of Appendix Skilled Worker of Immigration Rules; or

- If being sponsored under Table 2a of Appendix Skilled Occupations, the prospective applicant was sponsored by the same sponsor in the most recent grant of permission and the sponsor continues to sponsor them.

If any of the transitional provisions apply, the minimum salary threshold will be assessed against the following options:

Option F: £29,000 per year, £11.90 per hour and the going rate for the SOC 2020 occupation code

Option G (PhD in a subject relevant to the job): £26,100 per year, £11.90 per hour and 90% of the going rate for the occupation code

Option H (PhD in a STEM subject relevant to the job): £23,200 per year, £11.90 per hour and 80% of the going rate for the occupation code

Option I (Job is in the Immigration Salary List): £23,200 per year, £11.90 per hour and the going rate for the occupation code

Option J (New entrant): £23,200 per year, £11.90 per hour and 70% of the going rate for the occupation code

Option K (Job listed in Health and Education Occupation): £23,200 per year and the going rate for the occupation code (Table 3 of Appendix Skilled Occupations)

The going rate for Options F to J can be found in Table 2 of Appendix Skilled Occupations.

New salary levels

If the job does not fall under any of the above-listed options, then, new salary thresholds apply:

Option A: £38,700 per year, £15.88 per hour and the going rate for the occupation code

Option B (PhD in a subject relevant to the job): £34,830 per year, £15.88 per hour and 90% of the going rate for the occupation code

Option C (PhD in a STEM subject relevant to the job): £30,960 per year, £15.88 per hour and 80% of the going rate for the occupation code

Option D (Job is in the Immigration Salary List): £30,960 per year, £15.88 per hour and the going rate for the occupation code

Option E (New entrant): £30,960 per year, £15.88 per hour and 70% of the going rate for the occupation code

The going rates for Options A to E can be found in Table 1 of Appendix Skilled Occupations.

Changes to Global Mobility and Scale-Up Routes

Alike the Skilled Worker salary thresholds, the salary thresholds for the Global Mobility Routes have gone up. The good news is that the going rates for the Global Mobility Routes will continue to be based on the 25th percentile of roles within the relevant SOC code and can be found in Tables 2 and 2b of Appendix Skilled Occupations. However, the minimum salary thresholds have gone up from £45,800 to £48,500 per annum for Senior or Specialist Workers and from £24,220 to £25,410 for Graduate Trainee applicants.

Important to note that some SOC Codes which were eligible for sponsorship under the Global Mobility Routes are no longer eligible as of the 4th of April 2024. Such codes are now listed in Table 2b of Appendix Skilled Occupations and can be used by someone with permission on this route before the 4th of April 2024 and who is applying for an extension to continue working in the same role.

For the Scale-Up route, the general threshold has been raised from £34,600 to £36,300.

What is next?

By introducing the above changes, as stated in the Explanatory Memorandum, the Home Office intends to encourage UK businesses to invest in the resident workforce rather than over-relying on migration. This has been the aim for many years but changing the immigration policy has not [yet] brought the desired results.

What is certain is that the Immigration Rules are becoming harder to navigate even for experienced immigration practitioners and, coupled with the increase in Immigration Health Surcharge and other visa costs, it could be assumed that this could have been done intentionally to discourage businesses from employing foreign workforce.

This article has been published in line with the relevant Rules and policies that apply on the 24th of April 2024.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com