Registration as British for Irish citizens

The political relationship between the United Kingdom and Ireland dates back to the 16th century. Being the closest geographical neighbour, Ireland is the most important UK’s economic, trade, investment and tourism partner. Both countries form a part of the Common Travel Area which allows British and Irish citizens to move freely and reside in either country without restrictions, including the right to study or work.

In light of the UK’s exit from the European Union in 2020, the rights of Irish citizens in the UK remained protected. It was, however, possible for Irish citizens, as for any EU nationals, to apply for a status under the EU Settlement Scheme and even apply after the 30th of June 2021 deadline if there are reasonable grounds for making a late application.

The immigration relationship between Ireland and the UK, however, has not always been tranquil. Recently, there have been tensions over migration in the wake of the UK-Rwanda Agreement as there has been an influx of migrants arriving in Ireland from Northern Ireland, which forms a part of the United Kingdom.

For those Irish citizens, who wish to obtain British nationality, there have been several routes to do so. The most common route is naturalisation. Other than this, Irish citizens can become British by birth, descent or double descent.

This year, one more route has been introduced with the passing of the British Nationality (Irish Citizens) Act 2024. The Act makes provisions for Irish citizens to become British by registration having lived in the UK for 5 years and without sitting a citizenship (Life in the UK) and/or English language test, as required under the naturalisation process. The two-section Act sets out the absences limit that has to be met along with the non-previous breaching of immigration laws rule. In special circumstances, the Secretary of State may treat these requirements as being satisfied where they are not.

The relevant provisions set out in the Illegal Migration Act 2023 are preserved in this new Act, which restricts certain persons from applying based on the initial irregular arrival to the UK. Notably, however, there are no restrictions on the time that an applicant must hold Irish citizenship before submitting the registration application. As such, an applicant commencing residence in the UK as a non-Irish citizen and later acquiring Irish citizenship can be eligible to apply as long as the overall time spent in the UK before the date of application is at least 5 years.

The Act makes a welcome addition to the current legislation framework. The demand for British citizenship from Irish nationals is, however, yet to be seen.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

The Three-stages of Security for Costs

What is Security for Costs

Security for costs is an application that a party (Defendant during the proceedings) can make where they believe the other party (the Claimant) does not have the financial means to pay any legal costs awarded to the Defendant should the Claimant’s claim be unsuccessful at trial.

Who can apply for Security for Costs

Usually, an application for security for costs is made by a Defendant, however there are some circumstances where an application can be made by the Claimant (i.e. if the Defendant has made a counterclaim).

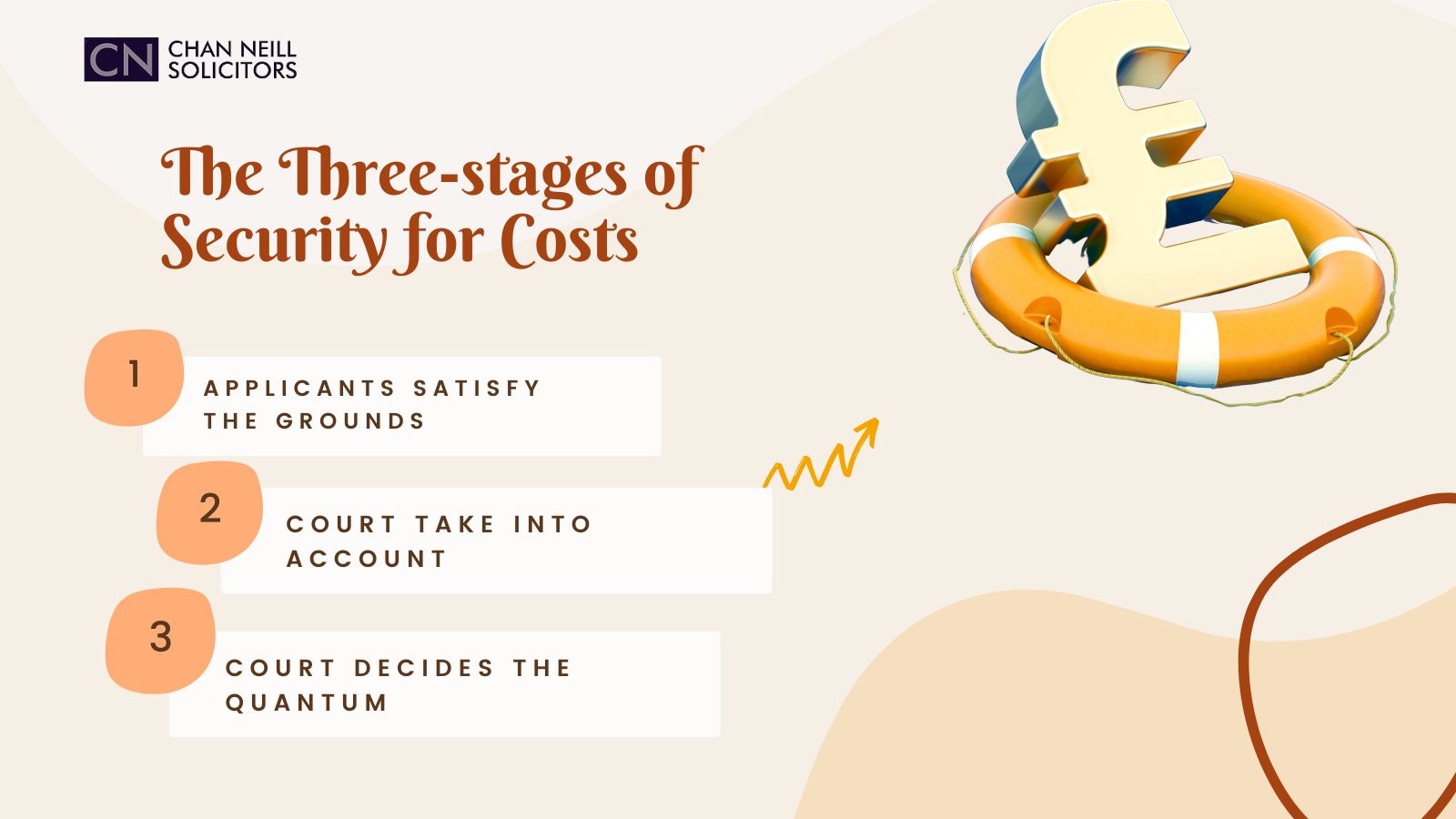

The 3-stage process that the Court consider

When the Court considers a security for costs application, there are three stages which are as follows:

- Grounds for Security for Costs

- Whether the Court should exercise its discretion

- Quantum

Grounds for Security for Costs

There are a number of grounds that the Applicant (the person making the application) must satisfy in their application (but not limited to) such as:

- Whether the Respondent resides outside of the UK (or is not a resident in a State bound by the 2005 Hague Convention)

- The Respondent’s address is incorrectly stated on the claim form

- The Respondent’s address is omitted from the claim form

- The Respondent has changed their address during the proceedings with the intention to avoid the cost consequences of the court proceedings.

What the Court’s take in to account

Applications for security for costs are usually dealt with at a hearing. The Court will consider all the relevant factors but not limited to the following points to decide whether the Court should exercise its discretion:

- Whether the grounds for Security for Costs have been satisfied

- How long the Applicant took to make the application

- The financial position of the Respondent

- The implications on the Respondent if an order for Security for Costs is made

- All circumstances of the case

- Whether the Respondent has After The Event insurance

Quantum

Once the court has decided that the grounds have been satisfied and that they should exercise their discretion to grant an order for security, the Court will then consider the amount of security and what form the security should be given.

Usually, the Applicant would request 100% of all their anticipated legal fees set out in their application (cost budget) however the court would review the Applicant’s anticipated costs and exercise their powers to assess the Applicants costs (like detailed assessment).

Conclusion

A party can make an application for security for costs at any stage during the court proceedings however, the earlier the application is made the better.

An Order for Security for costs is discretionary and the court would take in to account the time it has taken for the party to make such application which of course can have a detrimental effect on the court’s decision.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

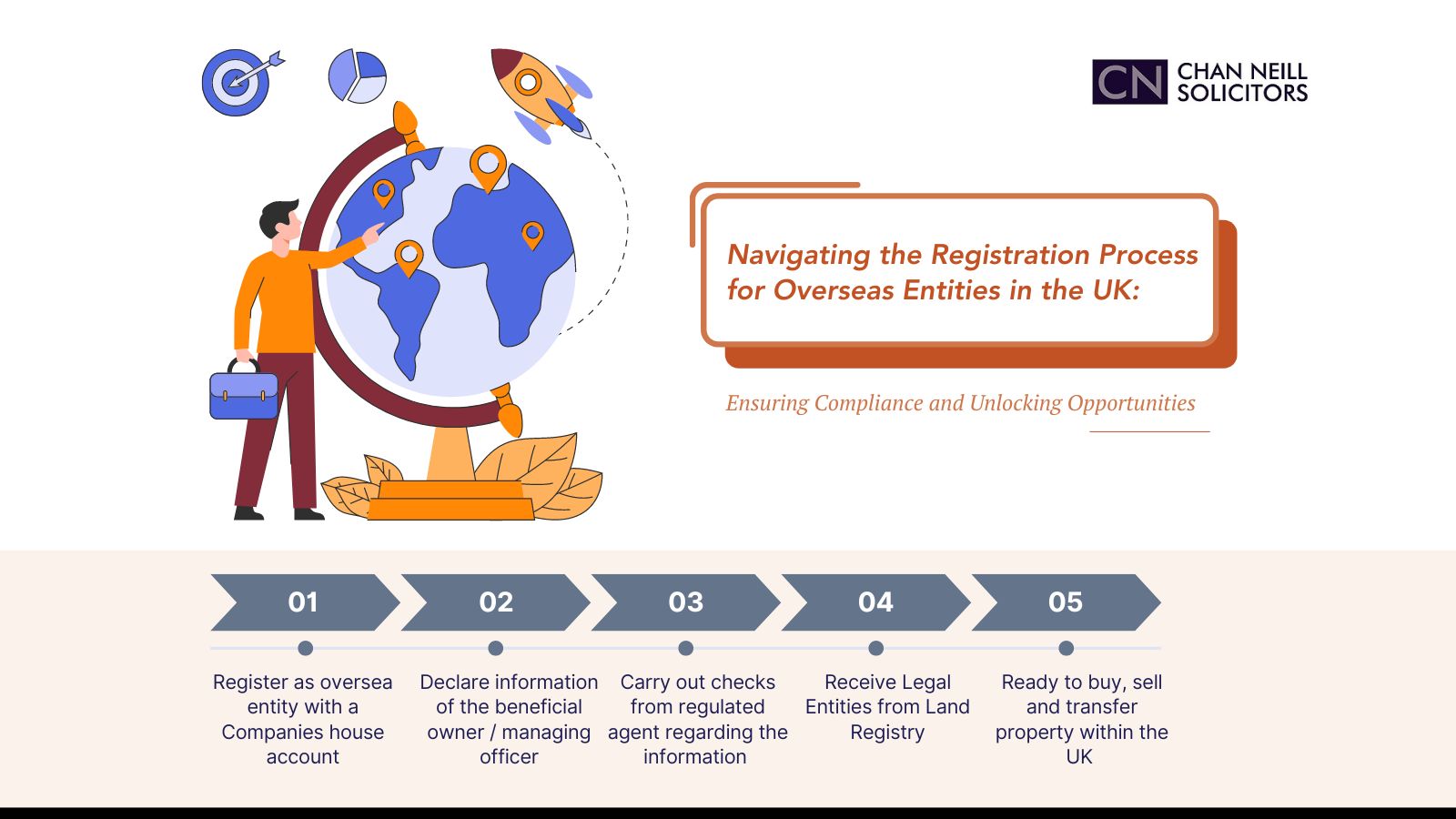

Navigating the Registration Process for Overseas Entities in the UK: Ensuring Compliance and Unlocking Opportunities

The UK continues to attract businesses from all corners of the globe. With its business-friendly infrastructure, environment and history, the UK remains a top destination for international entities seeking to establish a presence. However, for overseas companies looking to operate within the UK, navigating the regulatory landscape can be a daunting task.

One crucial step in this process is the registration of overseas entities, a procedure designed to ensure transparency, accountability, and compliance with UK laws. The Register of Overseas Entities (RoE) was established by the Economic Crime (Transparency and Enforcement) Act 2022 (ECTEA). It is regarded as an important step in dealing with global economic crime and furthering legitimacy within the UK property market.

The registration of overseas entities in the UK falls under the control of the Companies House, the government agency responsible for maintaining the official register of companies in the UK. Overseas entities seeking to establish a presence in the UK have historically had to register as an 'overseas company' if they plan to carry out business activities within the jurisdiction. On 26 October 2023, the ECTEA received Royal Assent, meaning that overseas entities which own UK property or land must declare information regarding their beneficial owners and/or managing officers.

To apply to register an overseas entity and its beneficial owners, the entity will require a Companies House Account. Detailed information about the overseas entity is required and its beneficial owners and/or managing officers will need to supply information about any relevant trusts, alongside the registration fee. A UK regulated agent based in the UK, often a law firm such as ourselves, must also confirm that they have carried out the requisite verification checks on the information regarding the beneficial owners and/or managing officers. It is therefore quicker and easier for the UK regulated agent to carry out the registration process themselves.

While the registration process may seem complex at first glance, it offers several benefits for overseas entities seeking to establish a foothold in the UK property market.

Legal Recognition: Registration as an overseas company provides legal recognition and legitimacy, enhancing the entity's credibility and reputation in the UK market.

Access to Markets and Opportunities: Registered overseas entities gain access to the vast UK market and can capitalise on business opportunities, partnerships, and investments within the country.

Enhanced Transparency and Compliance: By registering with Companies House, overseas entities demonstrate their commitment to transparency and compliance with UK laws and regulations, fostering trust among stakeholders and potential partners. If Companies have made an error in applications or have been delayed in registering, a concerted effort to communicate reasoning with Companies House should still be appreciated as a commitment to the transparency and compliance the ECTEA intended.

Protection of Rights and Interests: Registration affords overseas entities legal protections and safeguards their property within the UK, including the ability to sell, buy and lease the properties as well as resolve disputes surrounding the properties through the British legal system.

Once the entity has registered with Companies House, it will be issued with an overseas entity ID number (OEID). When the entity then enters property transactions, this number will be supplied to the Land Registry. The entity will then be able to buy, sell and transfer property within the UK whilst satisfying the regulatory requirements.

In an increasingly interconnected world, the registration of overseas entities in the UK serves as a gateway for foreign companies to new opportunities. While the process may involve complexities and regulatory requirements, it offers numerous benefits for businesses looking to expand their operations into the UK and its property market.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com